Whether you’re buying your first home or refinancing, mortgage interest can feel like a mystery. You know it adds cost — but how does mortgage interest actually work, and what does it mean for your loan?

This guide breaks it all down: what interest is, how it’s calculated, what influences your rate, and how it affects the total cost of your home over time.

What Is Mortgage Interest?

Mortgage interest is the cost you pay to borrow money from a lender. When you take out a loan to buy a home, you agree to repay not just the amount you borrowed (the principal), but also interest on that balance — charged as a percentage annually.

If your mortgage rate is 6.5%, you’ll pay 6.5% interest per year, applied to the remaining balance of your loan. But here’s where it gets more complex: mortgage interest is front-loaded, meaning you pay more interest at the start of your loan than toward the end.

How Does Mortgage Interest Work Over Time?

Mortgage loans are typically amortized, which means your monthly payment stays the same — but what it pays for changes over time.

-

In early years, most of your payment goes toward interest.

-

Later in the loan, more goes toward principal.

For example, on a $300,000 loan at 6.5%, your first payment includes about $1,625 in interest and just $372 in principal. By year 25, that flips.

Want to see your full amortization schedule?

Use our Mortgage Amortization Calculator to view your exact numbers.

Fixed vs Adjustable Mortgage Interest Rates

There are two main types of mortgage interest:

Fixed-Rate Mortgages (FRMs)

-

Interest rate stays the same for the life of the loan

-

Predictable monthly payments

-

Most common: 15-year and 30-year terms

Adjustable-Rate Mortgages (ARMs)

-

Interest rate starts low, then adjusts based on the market

-

Typically fixed for 5–7 years, then changes annually

-

Riskier if rates rise, but offers short-term savings

What Affects Your Mortgage Interest Rate?

Lenders consider several factors when setting your rate:

-

Credit score – Higher scores = lower rates

→ Learn how credit scores impact mortgage approval -

Down payment – More money down often earns better rates

-

Loan type – FHA, VA, and USDA loans often have different rate rules

-

Loan term – 15-year loans usually get lower rates than 30-year loans

-

Debt-to-income ratio (DTI) – A key metric lenders use to evaluate risk

→ Understand your DTI ratio -

Economic conditions – Inflation, the Fed, and bond markets all play a role

Real-World Mortgage Interest Cost Example

Let’s say you borrow $300,000 for 30 years:

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 5.0% | $1,610 | $279,767 |

| 6.5% | $1,896 | $382,633 |

| 7.5% | $2,098 | $456,017 |

Over the life of your loan, even a 1% change in rate could cost or save you tens of thousands of dollars.

How to Get the Best Mortgage Interest Rate

-

Boost your credit score before applying

-

Shop around and compare lenders

→ Use Loan Watch to compare real Loan Estimates -

Lower your DTI by paying off debt

-

Consider buying points to lower your rate

-

Choose a shorter term (15-year loans = lower rates)

Basics of Mortgage Interest

How does mortgage interest work on a monthly payment?

Mortgage interest is calculated each month based on your remaining loan balance. In the early years of a loan, most of your monthly payment goes toward interest. Over time, as the principal decreases, the interest portion shrinks and more of your payment goes toward the principal.

What is mortgage amortization?

Mortgage amortization is the process of paying off a loan with equal monthly payments over time. Each payment covers both interest and principal, with the interest portion gradually decreasing as the loan matures.

Are mortgage interest rates negotiable?

Yes, mortgage interest rates are negotiable. Lenders can offer different rates and terms based on your credit, loan type, and market conditions. Comparing offers from multiple lenders helps you secure the best rate.

Loan Types, Taxes & PMI

Which loans typically have lower interest rates?

VA, USDA, and FHA loans generally offer lower interest rates than conventional loans. VA and USDA loans are government-backed and often have more favorable terms for qualified borrowers.

Can mortgage interest be deducted on taxes?

Yes, mortgage interest can be tax-deductible if you itemize deductions. The IRS allows homeowners to deduct interest paid on loans up to a certain limit for primary or secondary residences.

Does PMI increase my mortgage interest rate?

No, PMI does not increase your interest rate directly. However, it adds to your total monthly payment and is often required if you put down less than 20% on a conventional loan.

Long-Term Strategy & Payments

Can I lower my interest rate after closing?

Yes, you can lower your interest rate after closing by refinancing. Refinancing replaces your current mortgage with a new one, ideally with a lower rate, which can reduce your monthly payment and total interest cost.

Does making extra payments reduce mortgage interest?

Yes, making extra payments reduces the total mortgage interest you pay over time. Extra payments are applied to your principal, which lowers the balance used to calculate future interest.

Final Thoughts

Understanding how mortgage interest works is critical to making smart decisions as a homebuyer. Interest rates not only affect your monthly payment, but also the total cost of your loan over time.

Be proactive: build credit, compare offers, and run the numbers before locking in a loan. And if you already have a mortgage, don’t forget to review your rate regularly — you might benefit from refinancing, especially if your original rate is higher than today’s average.

Related Posts

What to Do If Your Mortgage Is Denied (And How to Spot the Warning Signs Early)

Few things are more stressful than having your mortgage denied right before closing or after pre-approval. Unfortunately, it happens more often than many

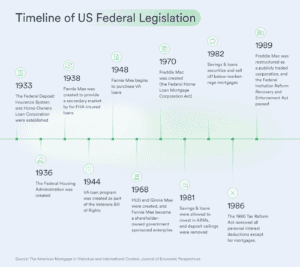

The History of Mortgage Lending in the United States

Mortgage lending has shaped the American dream for generations — but it wasn’t always the standardized, accessible system we know today. From early

What Affects Mortgage Rates? Key Factors That Influence What You Pay

When you’re planning to buy a home or refinance, one of the most important questions is: What affects mortgage rates? While the number